Hawala, from a Retrospective point of view.

Hawala existed before formal financial institutions and has prevailed for more than a millennium in the face of an ever-changing landscape.

Last week we looked at the use cases of Hawala and today we definitely want to look back at history.

Hawala existed before formal financial institutions and has prevailed for more than a millennium in the face of an ever-changing landscape.

Looking back to 618 A.D., ancient societies established IVTS like hawala—known as fei qian in China, hundi in India and Pakistan, padala in the Philippines, and xawilaad in Somalia— one reason behind this human innovation is to derisk carrying huge cash along trade routes and build equitable exchange rates for goods and services.

Within the Islamic community, hawala is codified as a means of legitimate banking in the hadith and through the application of Islamic law, shari’a.

For Africa, the colonial era paved the way for a new era of western institutions, which saw the dim decline of the hawala system, but it never totally vanished. In the past few years, as extreme conditions have greatly hampered the availability and accessibility of formal financial markets, hawala has had a resurgence as a more convenient, reliable, expedient, and inexpensive alternative to western methods.

Definition and workings!

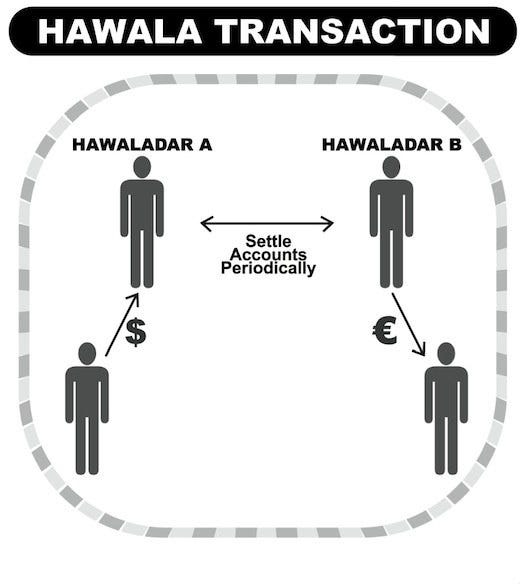

The Hawala system is a transaction in which certain value is moved from one party to another.

Basic description: A hawala transaction might work like this, Mr. Kwame in Ghana sending money to his wife in Lesotho. A local hawala store in Ghana contacts a local hawaladar and gives him a sum of cash to be delivered to Mr. Kwame's wife in Lesotho. The local Halwaladar contacts a partnering agent in the recipient country (Lesotho) who then delivers an equivalent amount of funds in the local currency; Mr. Kwame's wife will provide a secret code word to collect the money from the hawaladar.

A more complex hawala exchange may involve multiple individuals in different countries, several hawaladars, exchange houses to settle larger denominations of debts, and overlap into the formal banking sector. Transactions can cross a diverse range of countries' borders at different exchange rates, and multilevel hierarchies of intermediaries are sometimes employed to consolidate and settle high volumes of debt. Regardless of the complexity of the hawala exchange, cash is rarely, if ever, physically couriered between hawaladars. Instead, a method of net settlement is employed to satisfy debts between them. As hawaladars typically provide money-remitting services as an offshoot of a larger business, like a retail store, they can settle debts by invoicing other hawaladar-owned businesses. This invoicing is done by counter-valuation or the act of over-undervaluing export or import commodities.

Generally, hawaladars will pay or collect from one another using legitimate business accounts held at formal financial institutions.

Why does it still exist?

Hawala still exists in contemporary times for many reasons. For some users, cultural familiarity coupled with a distrust of western institutions perpetuates hawala’s use. For others, hawala is a more reliable, expedient, and inexpensive alternative to the formal system of remitting money. Hawala also offers a degree of anonymity that western institutions do not. Regardless of the motive for using hawala, the overarching, prominent attribute of this network is its global accessibility. Time and time again, while the formal banking sector has failed to adapt to extreme circumstances like war and repressive regulation, Hawala has continued to endure.

Conclusion

Finally, Hawala offers anonymity in a manner that formal institutions simply do not. With social and cultural ties and a heavy reliance on trust bind hawala transactions, bureaucratic processes are lacking, like registration, identity verification, and formal contracts that add to what is perceived by regulators as transaction data. Often, data is only kept for as long as the debt is outstanding, which then results in a diminished paper trail. Most commonly, records are maintained using codes and do not document a customer’s identity; instead, ledgers reflect transactions between hawaladars. In this way, hawala business practices differ drastically from modern western institutions.

Hawala continues to be used around Africa due to its availability, accessibility, and affordability. Unlike western banking institutions, which are modern-day creations, Hawala has a more extensive history of strengthening social and cultural bonds.

Trust in hawala as an institution has become foundational to its longevity. As a market competitor, hawala has outperformed formal remitting services by being more reliable, expedient, and cheaper. Thus, it continues to be relied upon to transport money globally. However, for these very reasons, Islamic extremist groups operating in Africa and the Middle East have exploited hawala.

Tweet of the Moment

Inspiration for the week ahead

Check this out if you are a founder

Please have you consider sharing Citural weekly with friends?

You can also subscribe if you haven’t.

This seems to work like mobile money. Though, without some components. I would like to ask, how do you keep records of users so they can have access to other financial products like mortgage?